It is no secret; what is good for the world is becoming increasingly good for business.

With the value of investment into global assets linked to responsible environmental, social and governance (ESG) practice on track to surpass $41 trillion by the end of 2022 and soar to $50 trillion by 2025,1 it comes as little surprise that the boardrooms of big business are fervently rolling out means to incentivise a positive shift in operations.

Current research suggests that the practice of linking pay to ESG is already widespread, with 82% of senior leaders already having ESG targets in their pay.2 These typically have reflected the company’s conventional strategic priorities, meaning a greater emphasis on topics such as employee engagement or health and safety.

However, in light of the findings of the Sixth Assessment report3 from the Intergovernmental Panel on Climate Change (IPCC), an increased urgency to address climate-based issues has been thrust forward in the collective consciousness of businesses and stakeholders alike. The Science Based Targets initiatives (SBTi) milestone announcement of surpassing 1,000 companies committed to the Net-Zero Standard reflects this.4

Consequently, we can expect an evolution of many companies’ strategic priorities that will translate directly into pay linked ESG targets. As it stands, 19% of companies across the major US & European indices currently incorporate climate and broader environmental measures in their employee incentive plans,5 with investor consensus firmly backing a shift towards a more holistic pursuit of accountability and transparency.6

So, whether you are already being - or soon to be - tasked on improving the ESG performance of your company, what actions will help you accelerate your ESG performance?

For most consumer companies, more than 80% of their environmental and social impact is attributable to their supply chain. Focusing on supply chain impact rather than direct operations holds the potential of a 24 times greater impact.7 Opting to pursue greater collaboration with your suppliers can therefore often have the greatest effect on overall business.8

Unfortunately, in practice this is not necessarily straightforward. In order to address your supply-chain impact you must first develop transparency with your suppliers of where issues may lie. This means overcoming several challenges, including suppliers who are unwilling to divulge information for fear of undermining their competitive advantage or exposing themselves to criticism.9 Alternatively other suppliers might be uninformed or uneducated on how to report the data you require, making any requests you make futile.

In order to combat this, a pragmatic approach focused around developing the skillset of your suppliers and the sharing of best practice is required, helping to cultivate increased receptiveness to change over time.

“Transparency is best understood as a process of continuous improvement.” (Gardner et al. 2019)10

To date, this type of incremental step change has been implemented poorly, leading to a slow response on behalf of suppliers, and environmental action not cascading down the supply chain. Only 38% of companies currently engage their suppliers around the topic of climate change and only 27% of suppliers disclose that they have a low-carbon transition plan in place.11

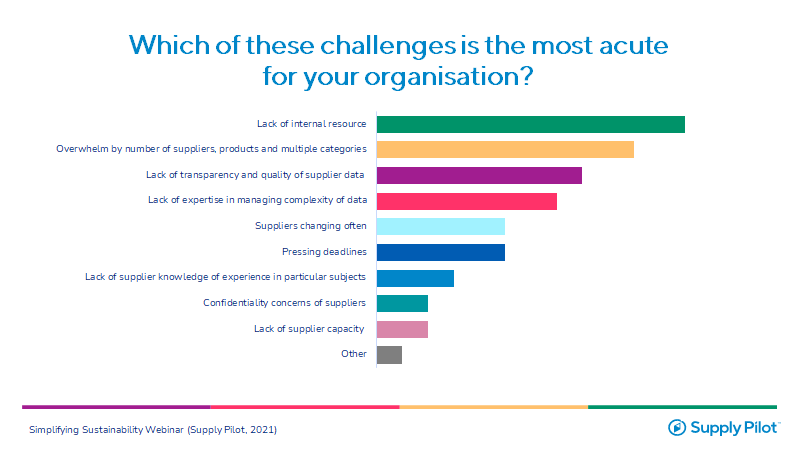

Responses to a poll within our Simplifying Sustainability webinar made it clear what the biggest challenges are for senior leaders when it comes to engaging suppliers around ESG issues. Notably the increased demand on already stretched internal resources was cited as the primary challenge, closely followed by the scale and complexity of suppliers with whom they need to engage.12

“Digital platforms applied in the context of multi-stakeholder non-governmental initiatives enable transparency leading to cooperation and integration between partners, strengthens trust and reduces or eliminates abuse of power.” (Gurzawska, 2020)13

At Supply Pilot, we seek to address the challenges being faced by a growing number of senior leaders tasked with improving ESG related performance. Whilst empathetic and supportive of the initiatives, many leaders would by their own admission not consider themselves ‘sustainability experts’, with tenure and expertise more closely related to their respective functions be it procurement, compliance, finance or otherwise.

Through a combination of our digital platform and in-house expertise we can help to alleviate the strain on your teams’ resources and enable you to overcome the scale and complexity of supplier collaboration.

Book a discovery call with us, and explore how we can help you improve your ESG performance through:

- Understanding which ESG issues you should prioritise.

- Developing an understanding of your supplier’s readiness and current receptiveness to ESG-related change.

- Quickly and accurately benchmarking supplier performance.

- Educating suppliers on issues that are materially important to your business and upskilling their ability to report on them.

- Holding suppliers accountable at scale to the improvement commitments that they’ve made to you.

- Commercialising your improvements to turn sustainability aspirations into a tangible ROI.

References:

- 1. Bloomberg (2022) ESG May Surpass $41 Trillion Assets in 2022, But Not Without Challenges, Finds Bloomberg Intelligence. https://www.bloomberg.com/company/press/esg-may-surpass-41-trillion-assets-in-2022-but-not-without-challenges-finds-bloomberg-intelligence/

- PwC (2022) Paying for good for all. https://www.pwc.com/gx/en/services/paying-for-good-for-all/Paying-for-good-for-all.pdf

- IPCC (2021) Sixth Assessment Report. https://www.ipcc.ch/assessment-report/ar6/

- SBTi (2022) Companies committed to cut emissions in line with climate science now represent $38 trillion of global economy. https://sciencebasedtargets.org/news/companies-committed-to-cut-emissions-in-line-with-climate-science-now-represent-38-trillion-of-global-economy#:~:text=The%20report%20indicates%20almost%2080,to%20the%20Standard%20surpassing%201%2C000.

- Willis Towers Watson (2021) Executive Compensation Guidebook for Climate Transition. https://www.wtwco.com/en-GB/Insights/2021/11/executive-compensation-guidebook-for-climate-transition

- S&P Global (2022) Key trends that will drive the ESG agenda in 2022. https://www.spglobal.com/esg/insights/key-esg-trends-in-2022

- McKinsey (2016) Starting at the source: Sustainability in supply chains. https://www.mckinsey.com/business-functions/sustainability/our-insights/starting-at-the-source-sustainability-in-supply-chains

- Supply Pilot (2022) From Intention to Action. https://www.supply-pilot.com/white-paper-intention-to-action

- Harvard Business Review (2019) What Supply Chain Transparency Really Means. https://hbr.org/2019/08/what-supply-chain-transparency-really-means

- Gardner, et al. (2019) Transparency and sustainability in global commodity supply chains. https://www.sciencedirect.com/science/article/pii/S0305750X18301736?ref=pdf_download&fr=RR-2&rr=7135481ccf6576c3

- CDP (2022) Engaging the Chain: Driving Speed and Scale. https://cdn.cdp.net/cdp-production/cms/reports/documents/000/006/106/original/CDP_SC_Report_2021.pdf?1644513297

- Supply Pilot (2021) Simplifying Sustainability Webinar. https://www.supply-pilot.com/

- Gurzawska, Agata. (2020) Towards Responsible and Sustainable Supply Chains – Innovation, Multi-stakeholder Approach and Governance. https://link.springer.com/article/10.1007/s40926-019-00114-z